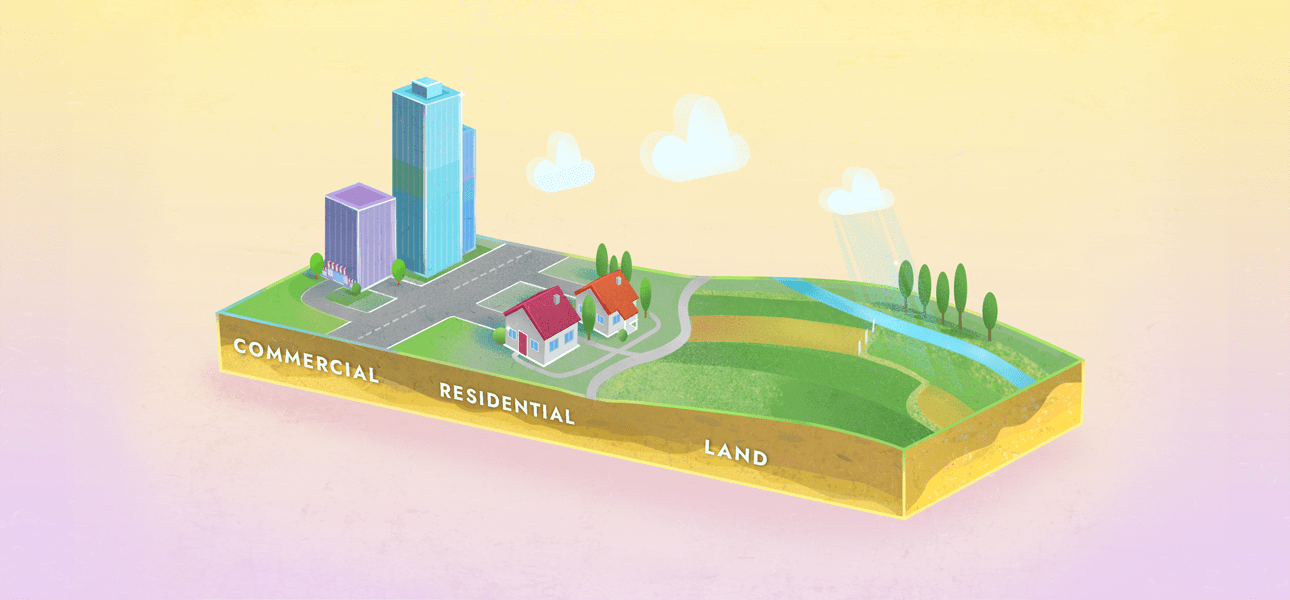

What Types of Real Estate are There?

The realm of real estate is vast and multifaceted, playing a crucial role in the global economy. Real estate investments span an extensive array of property types, from charming residential abodes to large-scale industrial infrastructures.

This article delves into the multifaceted real estate types, shedding light on their distinct attributes while critically assessing the advantages and disadvantages of investing in each type.

Residential

Investing in residential properties can yield significant short-term and long-term profits, as they are in high demand and offer various opportunities for capital growth and rental income. Below, we discuss four key types of residential properties that can be lucrative investment options.

Apartments

Apartment complexes are multi-unit residential buildings that can range from small complexes to high-rise towers. They often appeal to investors because they typically require lower initial investments and maintenance costs than other property types. By purchasing individual apartments within the building, you can benefit from rental income, while also capitalizing on potential increases in property value over time. In densely populated urban areas, apartments are particularly attractive investments due to their high demand and limited supply.

Cottages and houses

Cottages and houses provide a more traditional residential investment option. These properties can offer long-term capital growth as they typically appreciate in value over time, especially in desirable neighborhoods. Additionally, renting out cottages and houses can generate a stable monthly income. When choosing cottages and houses for investment, investors should consider location, local amenities, and neighborhood trends.

Additionally, it is imperative to ensure that the quality of the property aligns with the expectations of the potential target audience. For instance, a modest dwelling in a prestigious neighborhood may not attract the desired clientele, just as an extravagant mansion might need to be placed in a more modest residential community. It is essential to strike the right balance to cater to the market's specific demands and achieve successful investment outcomes.

Townhouses

Townhouses are a unique blend of single-family homes and apartments. They are typically attached to other townhouses in a row or a block, sharing common walls. Townhouses can be an attractive real estate type due to their lower maintenance costs compared to single-family homes, while still offering the benefits of individual ownership. Investors can reap the benefits of townhouses, as they uniquely combine the advantages of both private homes and apartments. This hybrid property type offers the potential for rental income and capital appreciation, particularly in regions undergoing population growth and urban development.

Resort real estate

Resort real estate includes properties within vacation destinations or recreational areas, such as beachfront condos, ski chalets, or golf course homes. These properties can be highly profitable investments, especially when managed as short-term vacation rentals. Resort real estate allows investors to capitalize on seasonal demand and more high rental rates while benefiting from potential long-term appreciation in popular tourist destinations.

When investing in resort real estate, it is crucial to take into account factors such as seasonality, which can significantly impact rental income and occupancy rates. Additionally, understanding the competitive landscape and ensuring that the property aligns with the preferences of the potential target tourist audience is vital for success.

Commercial

Commercial real estate properties are used primarily for business purposes. This section will explore four different types of commercial real estate, each with its unique advantages and challenges.

Retail

Retail properties include shopping centers, malls, and standalone stores, all of which cater to the sale of goods and services. When investing in retail properties, it's essential to consider factors such as location, tenant mix, and economic trends that may impact consumer spending. Additionally, well-located retail properties tend to appreciate in value over time.

Industrial

Industrial real estate covers properties used for manufacturing, production, storage, or distribution. Examples include factories, processing plants, and assembly facilities. Investors should consider the property's location, infrastructure, access to transportation, and the specific needs of potential tenants when investing in industrial real estate.

Warehouse

Warehouse properties are used primarily for storage and distribution of goods. They are a crucial part of the logistics and supply chain industry. As warehouse facilities are crucial for businesses to manage inventory and distribute products efficiently, rental agreements for such spaces are typically signed for a long term, which can have a positive impact on the stability and predictability of rental income. When investing in warehouse properties, key factors include location, access to transportation networks, and the property's layout and specifications, which should cater to the needs of potential tenants.

Office

Office real estate includes properties designed to accommodate businesses and their employees, such as office buildings, business parks, and coworking spaces. Office real estate values are often influenced by factors such as location, building amenities, and the overall economic climate. When investing in office properties, it's essential to consider the property's proximity to transportation, local market trends, and the potential for future growth in the area.

Also, investors should also pay close attention to the quality of the building, as office workers tend to prefer working in comfortable and modern facilities. By investing in high-quality office spaces, investors can attract and retain tenants, and potentially command higher rental rates.

Land

Investing in land presents a more flexible option for investors, as it allows buyers or renters the opportunity to construct buildings tailored to their specific requirements. However, this customization comes at the cost of time, which may lead many potential tenants or purchasers to prefer ready-made buildings for a quicker operational start. It is essential for investors to weigh these factors when considering land investments, balancing the benefits of flexibility with the demand for immediate usability.

Commercial and Residential Real Estate: Which One is Better?

Deciding between commercial and residential real estate investments depends on an individual's financial goals, risk tolerance, and investment strategy.

Residential real estate investments generally provide more stable returns, as people always need a place to live, regardless of economic conditions. These properties can offer consistent rental income, potential for capital appreciation, and are often easier to manage and maintain than commercial properties. However, residential properties may have lower returns compared to commercial real estate, especially in the short term.

Commercial real estate investments, on the other hand, can yield higher returns due to the potential for more significant rental income and long-term lease agreements. Commercial properties can appreciate in value if well-located and properly managed. However, these investments typically require higher initial capital, involve more complex management, and may be more sensitive to economic fluctuations and business activity.

Conclusion

As we've explored throughout this article, real estate encompasses a wide array of property types, each with its own unique characteristics, benefits, and drawbacks. Understanding the distinctions between residential, commercial, and land properties, as well as their various subcategories, is crucial for making well-informed investment decisions.

► Sabai Academy — a place where studying blockchain, crypto, fractional ownership, and real estate investments becomes a catalyst for capital growth!

Sabai Academy

BOOST your knowledge with our FREE crypto courses!

Related Articles

Real Estate Tokenization: Transforming Traditional Investments with Blockchain