Understanding Blockchain Bridges: Pros, Cons, and Key Insights

In recent years, blockchain technology has revolutionized various industries by introducing decentralized and secure solutions. One significant development within the ecosystem is the emergence of blockchain bridges. These bridges act as connectors, enabling interoperability between different networks and fostering a seamless flow of data and assets.

This article delves into the world of blockchain bridges, shedding light on their potential benefits, inherent challenges, and key insights that can help navigate this evolving landscape.

Table of contents

- What are blockchain bridges?

- Mechanics of blockchain bridges

- Types of blockchain bridges

- Unfolding the benefits of blockchain bridges

- The drawbacks of blockchain bridges

- Conclusion

What are Blockchain Bridges?

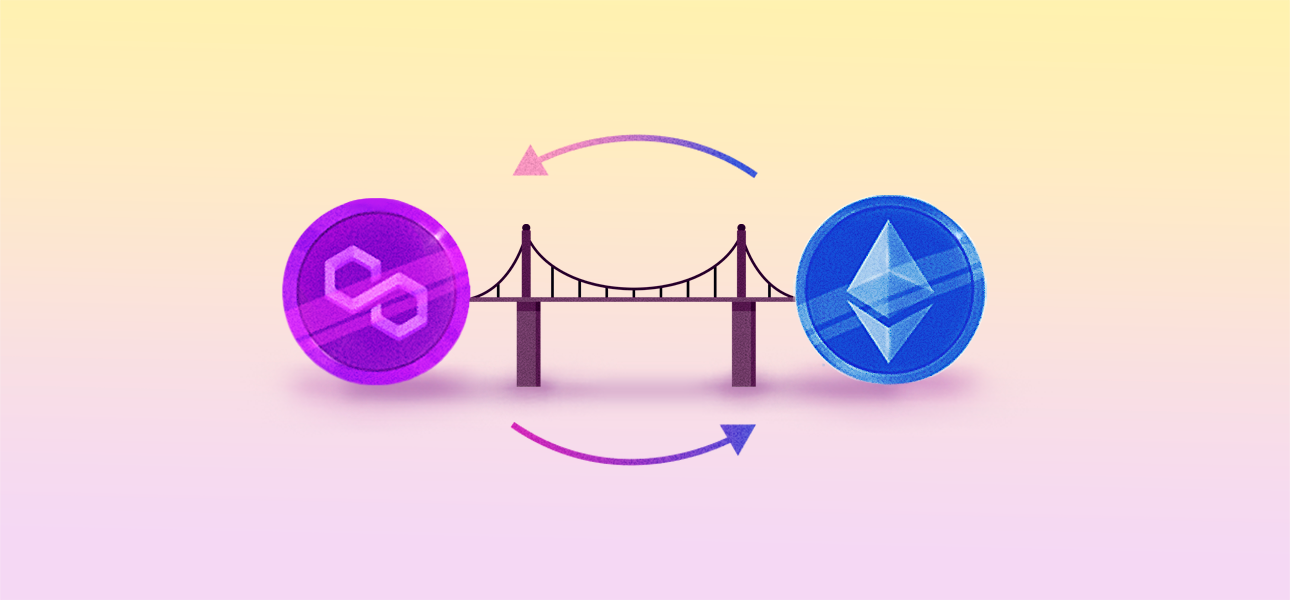

A crypto bridge is a connection that allows the transfer of tokens and/or arbitrary data from one blockchain to another. Both chains can have different protocols, rules, and governance models, but the bridge provides a compatible way to securely interoperate between them.

Think of it like this: imagine two islands (A and B), each with their own unique type of currency. People on these islands typically can't use their currency on the other island because the two islands use different systems to verify and manage their respective currencies.

Now, imagine there's a ferry service (Blockchain Bridge) that can convert the currency of Island A to the currency of Island B and vice versa. This allows people on Island A to spend their money on Island B, and vice versa. This "ferry service" essentially is what a blockchain bridge does: It allows you to use a token from one on another blockchain.

A more technical explanation of a crypto bridge involves complex processes like minting and burning tokens on respective chains, locking and releasing mechanisms, and sometimes even involves smart contracts or relay nodes to facilitate the transfers. But the basic idea is the same: a bridge allows different blockchains to interact and communicate in a trustless, secure way.

Mechanics of Blockchain Bridges

Let's visual the mechanics:

- Initiation: A user starts the process by submitting a transaction on Blockchain A that includes the amount of tokens they want to transfer and the address on Blockchain B where the tokens should be sent.

- Locking: The tokens on Blockchain A are locked up in a smart contract. This means they're taken out of circulation, so they can't be spent during the transfer.

- Verification: Validators verify the transaction has taken place. These are nodes that can access both Blockchain A and Blockchain B.

- Minting: Once the transaction is verified, an equivalent amount of tokens are minted (created) on Blockchain B. These tokens represent the locked tokens on Blockchain A.

- Delivery: The newly minted tokens are delivered to the designated address on Blockchain B.

When the user wants to move their tokens back to Blockchain A, the process is simply reversed. The tokens on B are burned (destroyed), and the original tokens on A are unlocked and returned to the user's wallet.

Remember, this is a simplified explanation. The exact mechanics can vary depending on the specific blockchains and bridge technology involved.

Types of Blockchain Bridges

Navigating the landscape of blockchain technology, it's crucial to understand the role and types of blockchain bridges. These bridges, which can be categorized as custodial or non-custodial, by function, and by their principle of operation, each with its distinct advantages and use cases.

Custodial vs. Non-custodial Bridges

- Custodial bridges: in a custodial bridge, a trusted third-party holds the assets being transferred. When a user locks their tokens in the smart contract on Blockchain A, the custodian takes custody of these tokens. The custodian then mints an equivalent number of tokens on Blockchain B. When the tokens need to be moved back to Blockchain A, the custodian burns the tokens on Blockchain B and unlocks the original tokens on Blockchain A. This type of bridge requires trust in the custodian.

- Non-custodial bridges: in a non-custodial bridge, there is no third-party custodian. Instead, the process is managed entirely by smart contracts and/or validators. This type of bridge is considered more decentralized and secure because it doesn't require trust in a single entity.

By Function

- Token bridges: these crypto bridges allow the transfer of tokens between two blockchains. The tokens are locked on the original blockchain and an equivalent amount is minted on the target blockchain.

- Data bridges: these bridges transfer information or data between two blockchains. This can include things like contract calls or the state of a smart contract.

Unidirectional vs. Bidirectional Bridges

- Unidirectional bridges: unidirectional bridges allow tokens or data to move in one direction only – from Blockchain A to B. Once the tokens have been transferred to Blockchain B, they cannot be moved back to Blockchain A using the same bridge.

- Bidirectional bridges: bidirectional bridges allow tokens or data to move in both directions – from Blockchain A to B and from Blockchain B back to A. This type of bridge is more flexible and is becoming more common as the interoperability between different blockchains becomes more important.

Each type of bridge has its own advantages and disadvantages. The best choice depends on the specific tasks and the characteristics of the blockchains involved.

Unfolding the Benefits of Blockchain Bridges

Blockchain bridges boast a fundamental advantage in promoting interoperability, a feature that is instrumental in ensuring seamless exchange of tokens, assets, and data across diverse blockchains. This is applicable whether the chains involved are Layer 1, Layer 2 protocols, or sidechains.

Another noteworthy advantage of blockchain bridges is the significant improvement they bring to scalability. Certain bridges are adept at handling a high volume of transactions, thereby enhancing the efficiency of the system. The Ethereum-Polygon crypto bridge serves as a prime example. This decentralized, bidirectional bridge functions as a scaling solution for the Ethereum network, enabling users to execute transactions with greater speed and reduced fees.

The Drawbacks of Blockchain Bridges

Blockchain bridges bring several challenges alongside their benefits. They can be vulnerable to security risks, such as hacking incidents, where frozen assets can be stolen, rendering tokens in a foreign blockchain worthless. Also, their operation is often complex, which can cause difficulties for users and increase the chance of errors.

Some bridges introduce a degree of centralization, which contradicts the decentralized ethos of blockchain. Not all blockchains can be bridged due to protocol differences, and liquidity can be an issue in less popular bridges, limiting their utility. Despite these challenges, efforts to improve bridges continue to evolve.

Conclusion

Blockchain bridges play a crucial role by enabling interoperability between different chains. Whether it's custodial or non-custodial, functioning for tokens or data, or operating uni-directionally or bi-directionally, each type of bridge has its special characteristics and uses.

► Sabai Academy — a place where studying blockchain, crypto, fractional ownership, and real estate investments becomes a catalyst for capital growth!

Sabai Academy

Join our FREE courses and get REWARDS IN CRYPTO!

Related Articles

What Factors Can Reduce the Expected Return on Real Estate Investment?