Understanding the 51% Attack: Threats and Implications for Blockchain Infrastructure Protection

Blockchain technology has revolutionized various industries by offering decentralized and transparent systems. One of the key aspects that ensure the integrity and security of blockchain networks is consensus mechanisms. However, no system is completely immune to threats, and in the realm of blockchain, one notable attack vector is the "51% attack."

This article delves into the intricacies of the 51% attack, exploring its definition, implications, and the real-world risks it poses to blockchain infrastructure.

Table of contents

- What is a 51% attack?

- How a 51% attack works

- Is the threat of a 51% attack real?

- Shielding against the threat of a 51% attack: is it feasible?

- Conclusion

What is a 51% Attack?

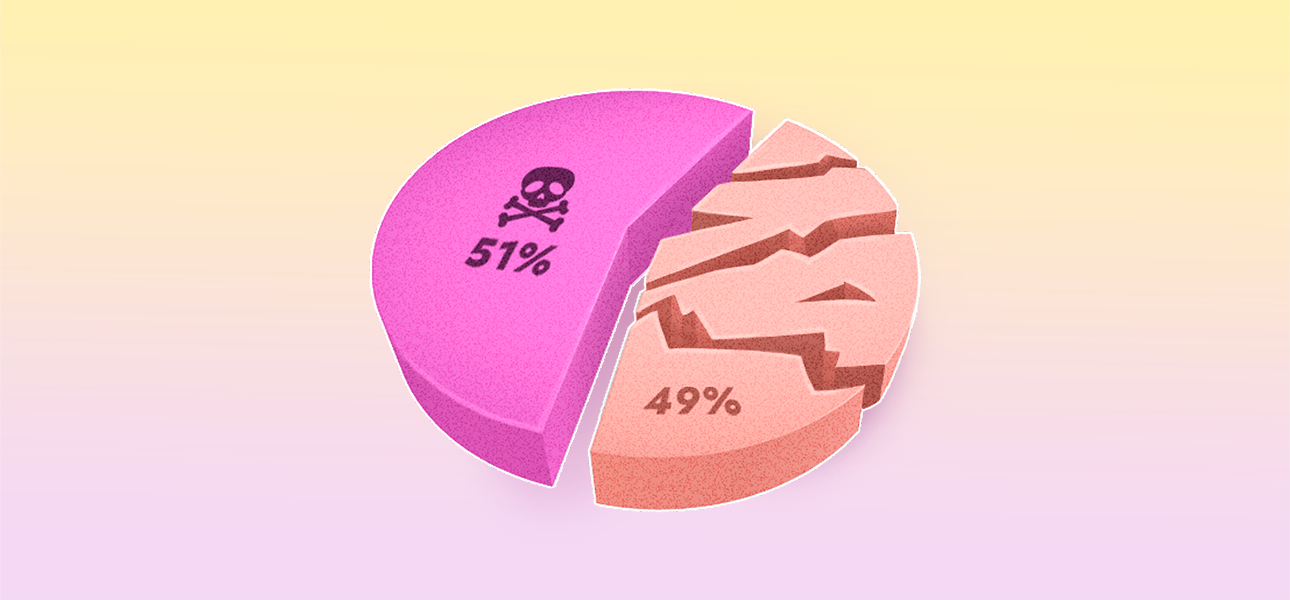

A 51% attack refers to a scenario where a malicious actor or a group of colluding actors gains control over more than 50% of the total computing power (hashrate) in a blockchain network. This control enables them to manipulate the network's operations, potentially undermining its security and trustworthiness. While the term "51% attack" is commonly associated with proof-of-work (PoW) blockchains like Bitcoin, it can also apply to proof-of-stake (PoS) and other consensus algorithms.

In a PoW blockchain, the attacker with majority control can disrupt the consensus process by excluding or modifying transactions, double-spending coins, or stopping new transactions from being confirmed. Additionally, they can attempt to reverse previously confirmed blocks, leading to a chain reorganization, also known as a "chain rollback." On the other hand, in PoS blockchains, where consensus is based on stake ownership rather than computational power, a 51% attacker can manipulate the protocol by having control over the majority of the cryptocurrency tokens.

The implications of a successful 51% attack can be far-reaching. It can compromise the immutability and trustworthiness of the blockchain, potentially leading to financial losses, eroding user confidence, and damaging the reputation of the network.

How a 51% Attack Works

Imagine a town where all decisions are made by majority vote. Now, suppose one person manages to control more than half of the town's population. They can manipulate the decision-making process because they always have the majority vote. In the world of blockchain, something similar can occur.

A blockchain is a distributed ledger where multiple copies exist across various computers, called nodes. When a transaction occurs, such as Alice sending Bob some Bitcoin, this transaction needs to be recorded on the ledger. However, before it can be added, it must be verified by nodes in a process called mining.

Consider our voting town again. Let's say Alice claims she's transferred 10 Bitcoins to Bob. The 'voters' (or miners in the blockchain) check their records to ensure Alice owns those Bitcoins and hasn't spent them already. If the majority agree, the transaction is approved and added to the ledger.

However, if someone controls 51% or more of the network's mining power, they can manipulate this process. They could potentially spend the same Bitcoin twice, a deceitful act known as 'double-spending'. They might approve their fraudulent transaction and reject genuine ones.

Launching a 51% attack is incredibly difficult and costly, because of the immense computational power and energy required. It's also not profitable, as it would likely crash the value of the cryptocurrency they're trying to defraud, defeating the purpose of the attack.

Is the Threat of a 51% Attack Real?

The threat of a 51% attack is a genuine concern for blockchain networks, although the likelihood and potential impact vary depending on several factors. These factors include the size and security of the network, the consensus algorithm employed, the cost and computational power required to execute the attack, and the economic incentives for honest participation in the network. While established and highly secure blockchains like Bitcoin have significant protection against 51% attacks due to their massive computational power and decentralized mining, smaller or less secure networks may be more susceptible to such attacks.

It is important to note that the mere existence of a 51% attack vulnerability does not imply an imminent threat. Blockchain developers and stakeholders continuously work on improving security measures and implementing consensus mechanisms that resist attacks. However, as blockchain technology evolves and attackers become more sophisticated, vigilance and proactive defense strategies are crucial to mitigate the risks associated with 51% attacks.

Shielding Against the Threat of a 51% Attack: Is It Feasible?

Standing up against a 51% attack in the blockchain world is feasible, similar to how a game of tug-of-war can be rebalanced when one side starts pulling too hard. When it comes to blockchains, we can restore balance by tweaking the rules of the game or joining forces to resist the stronger side. These strategies can significantly slow down an attacker or even exclude them from the game entirely.

It's important to remember that launching a 51% attack requires a considerable investment of time, energy, and financial resources. Moreover, if successful, it has the potential to wreck the value of the cryptocurrency, ultimately harming the attacker themselves.

In essence, while the prospect of a 51% attack might appear daunting, the blockchain community isn't powerless. The proactive and cooperative defense mechanisms can effectively counter such attempts, helping to maintain the integrity and security of the blockchain network.

Conclusion

The 51% attack is a real threat to crypto networks, as demonstrated by past incidents. Enhancing blockchain protection requires boosting network security, improving consensus algorithms, establishing robust monitoring, promoting decentralization, regular audits, and community consensus. By taking proactive measures against 51% attacks, the crypto community can safeguard the integrity of cryptocurrencies and ensure their continued growth and adoption.

► Sabai Academy — a place where studying blockchain, crypto, fractional ownership, and real estate investments becomes a catalyst for capital growth!

Sabai Academy

Smart Reward System exclusive for academy participants!

Related Articles

What Factors Can Reduce the Expected Return on Real Estate Investment?

FULL GUIDE: How to Buy $SABAI token